Massachusetts paycheck tax

Web If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. While the state auditor hasnt determined whether tax revenue has triggered a refund yet Gov.

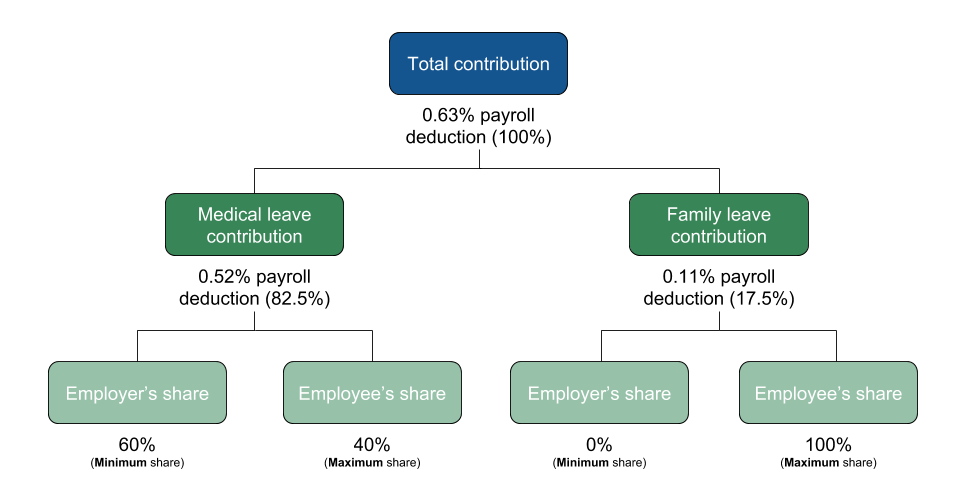

Massachusetts Fli Calculations

Web The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

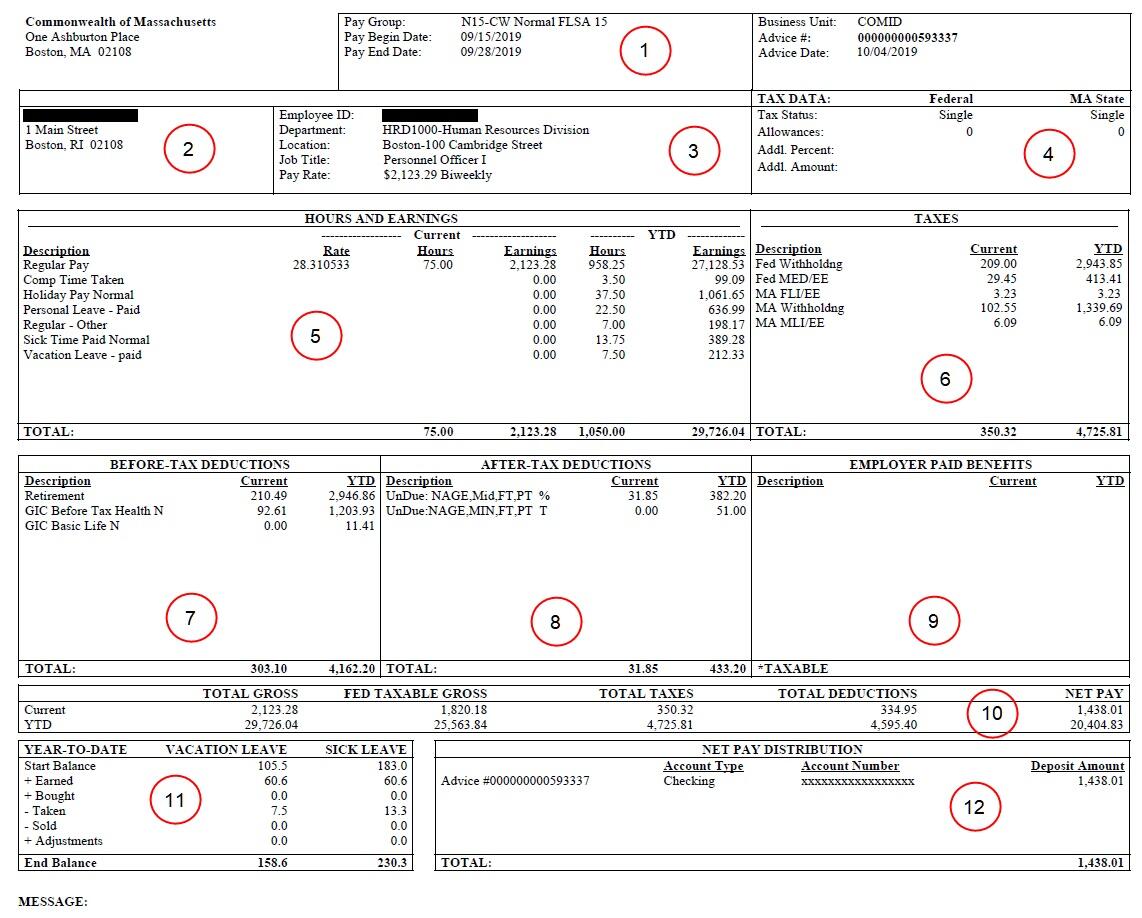

. Web Commonwealth of Massachusetts employees can report hours worked view state employee paychecks earned leave time Form W-2 and Form 1099 update personal information. Customize using your filing. Web Massachusetts Paycheck Calculator - SmartAsset SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes.

State Auditor Suzanne Bump announced Thursday. Ad Compare 5 Best Payroll Services Find the Best Rates. Contact Center hours are 9 am.

Massachusetts new hire online reporting. Web Tax year 2021 File in 2022 Nonresident. On or before April 15 for calendar year filings.

Web If you have to file andor pay on paper visit the Current tax filing season overview page. Business and fiduciary taxpayers must log in to. Web Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887-6367 or 800 392-6089 which is toll-free in.

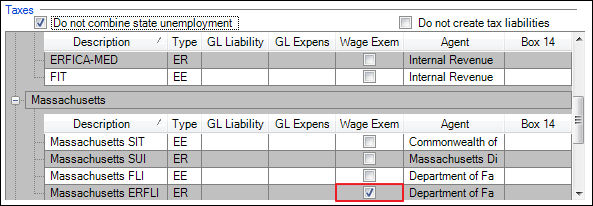

Web For an individual earning 75000 that would work out to about 250. Web Massachusetts Income Tax Calculator - SmartAsset Find out how much youll pay in Massachusetts state income taxes given your annual income. Web Payroll taxes in Massachusetts Massachusetts income tax withholding.

Web Massachusetts Department of Revenue. Web Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. As of January 1 2020 everyone pays 5 on personal income.

Web Massachusetts has a flat income tax rate of 5 so an individual who earned 50000 in taxable income last year and had a tax liability of 2500 could be in line for a. Business taxpayers can make bill payments on MassTaxConnect without logging in. Web The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income.

Note that you can claim a tax credit of up to 54 for paying your. Web For Business taxpayers. Your average tax rate is 1198 and your marginal tax rate is 22.

Web 1 day agoMassachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Massachusetts residents will see tax relief starting in November the Baker administration said Friday as officials prepare to dole out nearly 3 billion in excess.

This income tax calculator can help estimate your. Contacting the Department of Unemployment Assistance to fulfill obligations for. Web Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this.

Make Your Payroll Effortless and Focus on What really Matters. Web The amount of federal and Massachusetts income tax withheld for the prior year. Web There are state income taxes in Massachusetts as well as obligations for unemployment insurance workers compensation minimum pay frequency and final pay legislation.

It doesnt matter how much you make. The 15th day of the 4th month for.

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Payroll Software Solution For Massachusetts Small Business

Massachusetts Graduated Income Tax Amendment Details Analysis

Payroll Information Office Of The Comptroller

Paycheck Details Section

Learn More About The Massachusetts State Tax Rate H R Block

Massachusetts Graduated Income Tax Amendment Details Analysis

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

Massachusetts Paycheck Calculator Smartasset

Payroll Software Solution For Massachusetts Small Business

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

How To Calculate Massachusetts Income Tax Withholdings

Here S How Much Money You Take Home From A 75 000 Salary

How To Calculate Massachusetts Income Tax Withholdings

Massachusetts Paycheck Calculator Smartasset

Payroll Software Solution For Massachusetts Small Business